Metal Market Report July 2022 - Week 1 Edition

July 2022 - Week 1 Edition

First Half Review – The Worst U.S. Stock and Bond Markets in 150 Years!

The first half of 2022 is in the books, and President Biden is not having a good mid-term election year!

By most measures, the U.S. stock market had its worst first half since 1970, and many commodities are soaring, due to rising inflation, but if you dig deeper, the “tale of the tape” looks even worse than that.

Michael Hartnett of BofA (formerly Bank of America) Securities wrote on Friday, July 1, that in real (after inflation) terms the U.S. stock market is having its worst year since 1872. He also pointed out that government bonds have delivered their worst performance since 1865 - the year the Civil War ended and President Abraham Lincoln was shot. Meanwhile, commodities are having their best year in over 75 years, since 1946.

Although gold has been flat in the first half of the year in U.S. dollar terms, the Wall Street Journal’s Dollar Index is up 8.74% during the same period. Gold is also up over 8% in euro terms and up double-digits in British pounds (+10%), Israeli shekels (+11%), Norwegian krone and Swedish krona (+12%) and Japanese yen (+16%).

The surprise currency in the first half of 2022 is the Russian ruble, which gained 36% to the U.S. dollar, since Russia’s central bank has stockpiled gold since 2008 and put the ruble on a limited gold standard.

Some Sample First-Half 2022 Returns (in U.S. Dollar Terms) and Gold vs. Gasoline

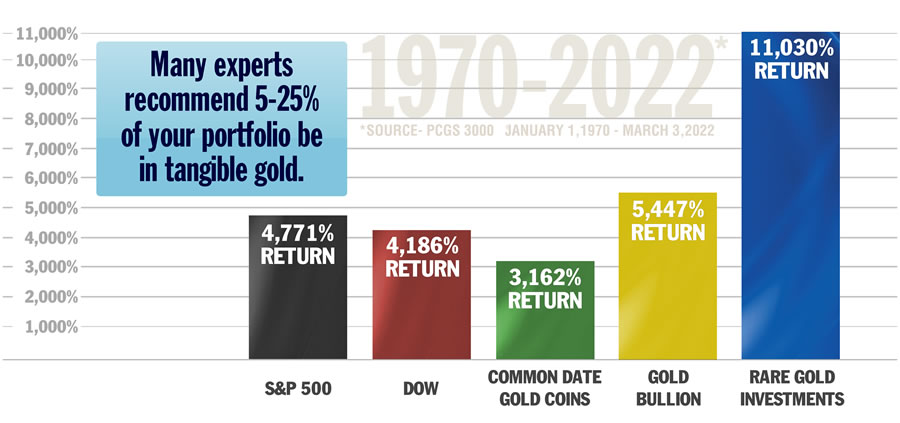

Longer-term, of course, gold continues to beat stocks by about 3-to-1, as our weekly chart shows, and gold is also beating gas at the pump in terms of inflation. In January 2000, an ounce of gold would buy 215 gallons of gasoline, based on data from the U.S. Energy Information Administration. Now, despite record-high gasoline prices and a flat gold price so far this year, that same ounce of gold will buy 368 gallons of gasoline, or 153 gallons (70%) more than 22.5 years ago.

Even better than gold bullion, the rare coin market continues to outpace almost every market in the last three years. Also, many of the coins we recommend are up 50% to 100%, or more, in the same timeframe; including a modern rarity like the 1996 $25 American Gold Eagle in MS-69 condition or a classic gold rare coin, like the 1894 $20 Liberty in MS-63, up about 125%. The chart below shows how gold bullion has beaten stocks in the 50+ years since the U.S. dollar went off the gold standard, but rare coins double even gold bullion!

U.S. Mint Gold Bullion Coin Sales Up in 2nd Quarter and First Half

The U.S. Mint has increased its sales volume of both the American Gold Eagle and Gold American Buffalo coins in the first half and second quarter of 2022, according to official U.S. Mint sales figures

This is good news, seeing that American Gold Eagle sales and total bullion gold sales rose at a faster pace in the second quarter than in the first quarter. This is also true of the record sales of gold ETFs this year. Remember, gold bullion sales make for an important indicator of future rare coin sales, since experience shows us that about one in six bullion coin buyers becomes a rare coin buyer within 18 to 24 months.

In addition, the U.S. Mint asked their distributors (“Authorized Purchasers,” or APs) in a questionnaire last May to estimate how many $5 American Gold Eagles they expected to sell through the end of the year, so the Mint could adjust their production. Last month, we heard that the APs would only get a small fraction of what they told the Mint they needed for the remainder of 2022.

This is unusual in two regards: (1) May is very early for the Mint to ask this of APs, foreshadowing an early sell-out of $5 Gold Eagles, and (2) this tells us that $5 American Gold Eagles dated 2022, popular in ads, could become hard to find and in high demand. So, if “Made in America” gold is important to you, please place an order for these 2022 $5 (1/10 ounce) American Gold Eagles now.

Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher.

100% Customer Service Hotline - Toll Free: 877.877.2256

FREE AND FAST DELIVERY

Free delivery for all orders over $199

24/7 CUSTOMER SERVICE

Friendly 24/7 customer support

MONEY BACK GUARANTEE

We return money within 30 days