Metal Market Report July 2022 - Week 3 Edition

July 2022 - Week 3 Edition

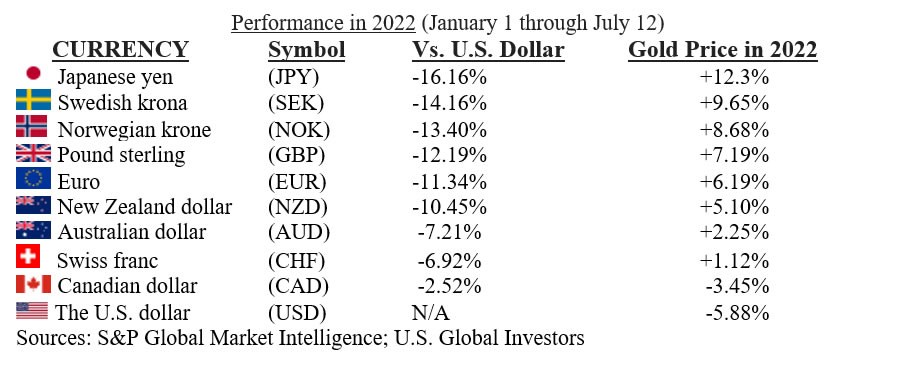

The Dollar Beat all Other G-10 Currencies – with Gold Rising in 8 of 10 Top Currencies

The G10 currencies aren’t necessarily the world’s 10 largest economies, but they are the 10 most widely traded world currencies. According to Wikipedia, “The G10 currencies are ten of the most heavily traded currencies in the world, which are also ten of the world's most liquid currencies.” The G10 currencies are:

Gold has risen in 8 of the 10 leading currencies through July 12 this year – all but the U.S. and Canadian dollars. Here’s how the process works. At the start of the year, gold was $1,820, but the euro was worth $1.126 USD. Divide $1,820 by $1.126, and the price of gold in euro terms was about €1,616 euros on January 1.

Now, that the euro is down to nearly “par” with the dollar, trading at $1.0018, with gold at $1,713, gold now trades at €1,716 euros, or 6.2% higher than at the start of the year, so euro gold is doing just fine.

This news is not much consolation to U.S. and Canadian investors but most investors outside of North America are not complaining about their gold profits this year. If you’re looking for consolation, then gold’s technical position is, in a word, “oversold.” Most investors who needed liquidity or who became disenchanted with gold have already sold it, so remaining gold investors are “strong hands.”

Despite Strong Dollar, Gold Hovers Around $1700

Gold has stayed above its $1,700 support level but its recent decline is almost entirely due to an ultra-strong “King Dollar,” especially in the last two months. Silver tends to be “gold on steroids,” on both the upside bull market moves and on the downside, so silver is down about three times more than gold this year. The strong dollar has also helped inflation rates shrink over the past seven weeks, since commodities are priced in dollars. Gold and most other commodities have declined since May 31, but mostly in U.S. dollar terms. Inflation rates are far higher in terms of the euro, yen, pound and other major non-dollar currencies lately.

Our Staff Joined “Freedom Fest” in Las Vegas This Year

For the first time in many years, we sent a large contingent of our account managers with a huge array of gorgeous gold and silver coins to the 15th annual Freedom Fest in Las Vegas last week. My friend and frequent writer for our companies, Gary Alexander, was also there to take notes on dozens of the best talks. He mentioned that Steve Moore made a couple of excellent points in Thursday’s opening “Global Economic Summit.” First, Moore revealed that a new study he undertook found that of the top 68 Biden appointees (including cabinet members), 62 percent of those who deal directly with business, economic policy, regulation, energy, finance and regulation had NO business experience. Only one in eight had “extensive” business experience and their average experience was 2.4 years – yet they are now in charge of a $22 trillion economy! Moore said we have lawyers, professors and community activists running America, with the obvious result of several “clueless” policy decisions (from a business perspective).

Moore also said that we are repeating German Chancellor Angela Merkel’s experience in Germany – where Modern Monetary Theory (MMT), or extreme money printing, and extreme Green policies, are now crippling Germany. He says we are about five years behind Merkel’s disastrous decisions. In 2015, Merkel was TIME Magazine’s “Person of the Year,” but now Germany is “the sick man of Europe,” according to The Daily Telegraph. Merkel basically decided to Go Green while relying almost entirely on Putin’s natural gas, a terrible mistake. She also refused to pay the mere 2% of GDP required for their NATO defense shield, so once again Europe has to rely on Uncle Sam for its defense against aggressors.

There were several bullish gold speakers there, and several other speakers were from the energy business, and they nearly all took offense to the Biden brain trust’s mantra of calling high gas prices “Putin’s gas tax,” or hearing Biden calling on “greedy” gas station owners to roll back prices when their profit margins are already so narrow that they need to sell junk food and other cheap goods to make a profit. The real major cause of inflation is the $6+ trillion in new money printed in 2020 and 2021 – far more than was needed.

A couple of speakers on the Global Economic Summit said MMT is neither modern (since over-spending is as old as time), nor monetary (it’s the deficit spending, stupid), nor a theory – it’s a reality! From February 2020 – before COVID struck – through February 2022, the U.S. Treasury’s debt load held by the public grew by $6.1 trillion, from $14.8 trillion to $20.9 trillion (+41.2%). In parallel, M2 money supply soared by $6.4 trillion, from $15.4 trillion to $21.8 trillion (+41.6%). That is mostly what caused inflation and in the long run typically results in gold rising in price compared to other world currencies.

High taxes? High rates? Recession? Deep deficits? Higher inflation? There is no free lunch with MMT!

Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher.

100% Customer Service Hotline - Toll Free: 877.877.2256

FREE AND FAST DELIVERY

Free delivery for all orders over $199

24/7 CUSTOMER SERVICE

Friendly 24/7 customer support

MONEY BACK GUARANTEE

We return money within 30 days