Metal Market Report August 2020 - Week 4 Edition

August 2020 - Week 4

Flash Alert! Two Hurricanes are Headed for Beaumont – But We Are Prepared!

As of Monday Morning, when we planned to send out this Metals Report, two hurricanes were headed for the Texas Gulf Coast near our border with Louisiana. First, Hurricane Marco has been downgraded to a tropical storm for the time being, but it may hit our coast Tuesday night. Hurricane Laura is predicted to be a Category 2 hurricane at present and it is likely to hit near Beaumont on Wednesday night. Although there may be some difficulty reaching us by phone for a while, if the past is any guide, we will relatively soon after the storm passes be able to take your orders and ship products again in a timely manner.

Back in 2005, just after the more infamous Hurricane Katrina devastated New Orleans due to a breach in the levees there, the much more powerful Hurricane Rita struck the Texas coast. Rita came just two weeks after Katrina, hitting Texas September 24, 2005. In fact, three of the seven most intense Atlantic hurricanes ever recorded came in a two-month period. #1-Wilma (October 2005), #4-Rita and #7-Katrina.

Wilma only crossed southern Florida from the Yucatan, never coming near Texas, but Rita devastated our region. Rita reached Category-5 status reaching 185 miles per hour, the strongest winds ever in the Gulf of Mexico. It was Category-3 by the time it hit us. Still, our buildings were solid and held firm. Our vault and coins came through safely. We have never had any flooding issues at our offices.

There is little danger of looting. I’m on the board of Crime Stoppers in Beaumont, and we often have extra help from family members as well as local police officers cruising by to make sure we are protected as a Beaumont Police Department substation is located in our building.

Rita was very devastating to the Beaumont community. I’m proud that our staff was a big part of the relief effort for those in need following that and other storms that have hit our region since then.

If you have problems reaching us by phone this week, please understand we will get back to you as soon as possible.

Gold Had a Roller Coaster Week

Gold had a roller-coaster week, topping $2,000 an ounce again last Tuesday, August 18, as the U.S. Dollar dropped to its lowest point in two years, falling over 10% in a 5-month period since March 18. Then, gold drifted lower as the dollar rallied. On Friday morning, August 21, gold fell from $1,950 down to $1,910 before rallying back above $1,940 as U.S. initial jobless claims climbed back above 1 million again.

Gold is Rare, Paper is Cheap: That Should Spell Higher Gold Prices

The dollar is down 10% in the last five months in part because the Federal Reserve added $3 trillion to its balance sheet and the U.S. Congress passed $3 trillion in relief packages through May with more to come.

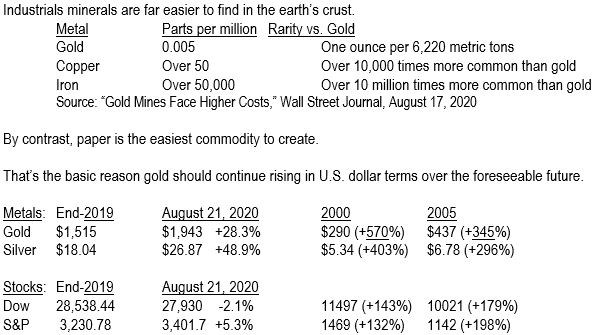

The 2020 federal deficit is $2.8 trillion through July 31. All this compares with a paltry 108 million ounces of new gold mined each year. Even at $2,000 per ounce, that’s only $216 billion, less than 10% of the budget deficit and less than 1% of annual GDP. Gold is very hard to find, and it is increasingly found only in politically dangerous jurisdictions or in difficult geographical locations for mining equipment.

In the earth’s crust, gold is found in only 0.005 parts per million (5 parts per billion) globally. The grade of mineable deposits these days is like finding a needle in a haystack, averaging 1.46 parts per million.

Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher.

100% Customer Service Hotline - Toll Free: 877.877.2256

FREE AND FAST DELIVERY

Free delivery for all orders over $199

24/7 CUSTOMER SERVICE

Friendly 24/7 customer support

MONEY BACK GUARANTEE

We return money within 30 days